Tax Advantages of

oil & Gas Investing

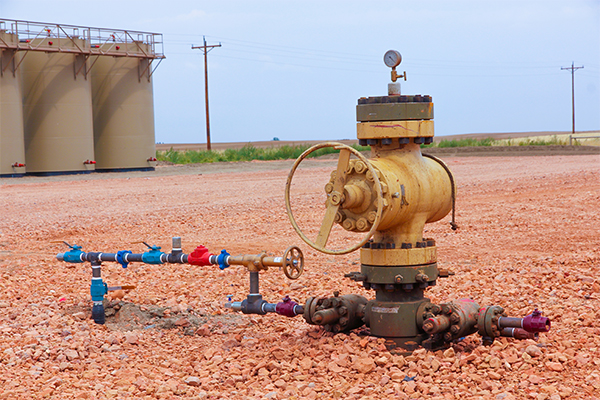

Several major tax benefits are available for oil and gas companies and investors that are found nowhere else in the tax code.

active vs. passive Income

The tax code specifies that a working interest (as opposed to a royalty interest) in an oil and gas well is not considered to be a passive activity. This means that all net losses are active income incurred in conjunction with well-head production and can be offset against other forms of income such as wages, interest and capital gains.

DEPLETION ALLOWANCE

The IRS also gives a 15% depletion allowance against production revenue to allow for the drop in oil and gas reserves in a well. The 1990 Tax Act allows certain entities to exempt 15% of their gross income from federal taxes to help support smaller oil companies and direct investors.

ALTERNATIVE MINIMUM TAX

The Energy Policy Act of 1992 repealed both ATM preference items, percentage depletion and IDC, for independent producers and royalty owners, not integrated oil companies. All excess intangible drilling costs have been specifically exempted as a “preference item” on the alternative minimum tax (AMT) return. The AMT was established to ensure that taxpayers paid a minimum or their “fair share” of taxes by recalculating the income tax owed, adding back specific preferential tax deductions or items.

Take the next step to invest

DW partnerships are structured to maximize the potential benefits of direct participation in domestic oil and gas exploration and production. Contact us to learn more.

TAX DEDUCTIONS EXAMPLE

See a hypothetical example of how 90% of your investment could be deductible in the first year.

why OIL & GAS

Domestic energy production is a national priority – energy fuels the economy and powers cities, state and governments. Another reason for these deductions is the inherent risk, and traditionally high buy-ins, involved in oil and gas investing. Tax Breaks for investors provide financial benefits for oil and gas investing, regardless of the drilling outcome.